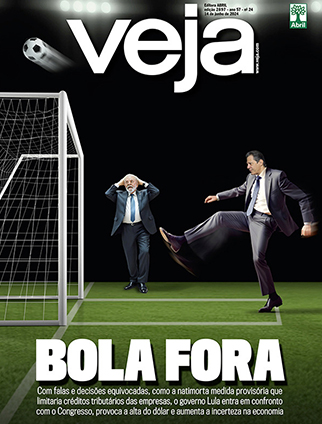

Abuse 3 – 1 Corruption

For every Real stolen from Petrobras, the company has lost three because of state interventionism

The billions of Reais subtracted from Petrobras in the big corruption scandal known locally as the “petrolão” have undermined the state-controlled company´s financial position and led it into the embarrassing position of not publishing its quarterly financial statements. Losses to date are estimated at R$ 20 billion. However, the loss by Brazil´s biggest company brought about by the government of President Dilma Rousseff using it for political purposes is much higher than the amount siphoned off by the gang captured in the federal police operation known as Carwash (Operação Lava-Jato). The main factor behind the destruction of Petrobras´s assets has been its pricing policy. The government decided to prevent inflation breaking through the ceiling of its official target, as did not want to fight inflation head on, by deciding to freeze making adjustments to the prices of gasoline and fuel. Petrobras has been forced to endure a billion dollar loss by selling gasoline and fuel at prices below what it has to pay to import these products as Brazil´s domestic production is not enough to supply its needs.

The accumulated losses from Petrobras´s supply operations amounted to R$ 60 billion by last June – three times the amount that was diverted. This is half the sum Petrobras raised through a share issue in June 2010 when it aimed to capitalize itself to pay for the exploration of the pre-salt layer oil reserves. As a result of the government´s policy of using Petrobras to suit its own ends and not to reward its shareholders, the company has lost its appeal to investors. Its market value has slumped by 59% since the start of the Rousseff administration. This is a loss of R$ 226 billion. (See the illustrations below.) When measured in dollar terms, the share price has fallen even lower, by more than 70%. In comparison, the market capitalization of the American company Exxon rose by 10% and the Anglo-Dutch giant Shell expanded by 13% during the same period.

An analysis of the Brazilian market shows that Petrobras´s performance is reflected in other state-controlled enterprises which have also been the victim of the government´s lethal interference. The electrical energy company Eletrobras is set to end 2014 with a loss for the third consecutive year and faces the risk of not distributing dividends to its shareholders for the first time ever because its reserves have run out. Its operating and financial difficulties have worsened over the last two years. It was the electrical energy company that was hit most by the federal government´s decision to renegotiate energy prices at the end of 2010. This led to an accounting loss of R$ 10 billion. Its revenues were then hit by a cut in the electricity tariff. It has been losing money more recently due to the low level of the reservoirs of the hydroelectric plants. As the generation is below expectations, Eletrobras has been forced to acquire energy on the spot market at higher prices to meet its consumer supply contracts. These expenses came to R$ 6.8 billion in the first nine months of this year. The publicly-controlled banks have also been submitted to interference that has adversely affected their results. This can be seen when the performance of state-controlled Banco do Brasil is compared with that of the largest privately-owned banks.

“This is how the present government thinks, i.e., the state knows everything and can do everything,” said Sergio Lazzarini, professor at the Insper business school and author of the book Capitalismo de Laços (Capitalism in Knots). “The lesson is that using state-controlled enterprises to control prices does not work. You break the company and don´t solve the problem because it is very difficult to row against the current of market forces. The best method is to create an environment with stable rules that allows the companies to invest and increase their efficiency over time.”

SEGUIR

SEGUIR

SEGUINDO

SEGUINDO

Putin fala em conflito global e diz que Rússia está ‘pronta para combate’

Putin fala em conflito global e diz que Rússia está ‘pronta para combate’ A apresentadora do SBT que ficou no meio de ‘fogo cruzado’ com a Globo

A apresentadora do SBT que ficou no meio de ‘fogo cruzado’ com a Globo O que o resgate do cavalo Caramelo revela sobre o Brasil

O que o resgate do cavalo Caramelo revela sobre o Brasil SBT apaga vídeo comprometedor sobre doações no RS

SBT apaga vídeo comprometedor sobre doações no RS O próximo astro internacional a se apresentar em Copacabana

O próximo astro internacional a se apresentar em Copacabana